Reserve Protocol and its Reserve Rights token (RSR) has been gaining interest for months. As the RSR token has quietly gained traction, RSR tokenomics are also gaining recognition. The Reserve app is already used in places like Venezuela as a safe-haven against hyperinflation. However, the Reserve Protocol also reduces the risk for DeFi users and yield farmers thanks to its Reserve token.

Reserve Protocol aims to build a censorship-resistant stablecoin and decentralized fiat gateway network that serves as a borderless, inflation-resistant store of wealth, that can be easily transacted with low friction. Furthermore, the goal is to create a stablecoin that cannot be debased and is free from government corruption.

In this article, we’re going to dive deep into the Reserve Protocol and see exactly how it operates. Also, we’re going to look at the Reserve Token (RSV) and the Reserve Rights token (RSR). We’ll look at the RSR tokenomics, the different uses for the tokens, and what makes Reserve such a powerful project.

Undoubtedly, it is an extremely exciting time for the world of crypto. If you’re new to the space and want to get up-to-speed, we highly recommend Ivan on Tech Academy. From our Crypto Basics course to Ethereum Programming and Algorithmic Trading, Ivan on Tech Academy is the best place to start your education in crypto, regardless of prior experience!

Reserve Protocol Background

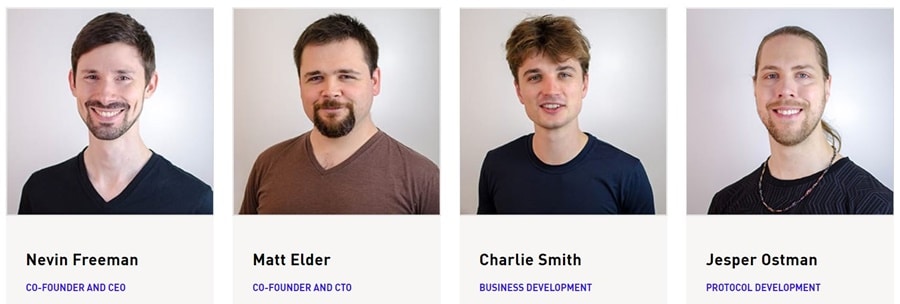

The Reserve Protocol project was founded by a team with impressive credentials and experience. CEO and co-founder Nevin Freeman is a serial entrepreneur who founded MetaMed Research Inc. and Paradigm Academy. Alongside him is Co-Founder and CTO, Matt Elder, who previously worked as an engineer at Google and IBM. The Reserve team is based in Oaklands, CA, US. However, the team spans several parts of the globe.

According to Reserve’s website, the Reserve Protocol has three planned phases of its rollout:

The Centralized Phase

Reserve is backed by a small number of tokens as collateral. Each token will be denominated in USD.

The Decentralized Phase

Reserve is backed by an agile basket of assets that are denominated in USD, but these assets are decentralized.

The Independent Phase

Reserve is unpegged from USD, with the aim of stabilizing purchasing power irrespective of the value of USD.

The Reserve app is currently available in Venezuela, Argentina, and Colombia. By the end of January 2021, the Reserve app will begin accepting new users, so-called “Beta-Rangers”, after several months of development.

What is Reserve Protocol?

Reserve Protocol recognizes currency debasement, and slow, costly international transactions, and has created an innovative solution to remedy this. The Reserve Protocol is designed to host a completely decentralized stablecoin, that can not be manipulated or inflated by governments. Furthermore, the team behind Reserve Protocol wants to create a fully self-sustainable platform, with decentralized governance and developments.

The Reserve Protocol was built on Ethereum. However, it can be implemented on its own chain or on top of any other smart contract platform. The long-term goal is for total interoperability of the Reserve token across all smart contract-enabled blockchains.

Three phases were initially proposed, with the first phase intended to be carried out in 2019. However, this was skipped as Reserve launched at phase two, allowing for earlier decentralization and adoption.

What is the Reserve Token?

The Reserve token (RSV) is a non-volatile cryptocurrency created by Reserve Protocol. Completely decentralized, the RSV token is backed by a changing basket of digital assets. In 2019, at the time of launch, these assets included USD Coin (USDC), True USD (TUSD), and Paxos Standard (PAX). The basket of currencies changes over time and will continue to utilize new assets as they become available.

The Reserve token has been designed to be used just like any other digital dollar or fiat currency. Importantly, the RSV token is helping people that face hyperinflation and instability from their national currency. This is achieved by providing a stable, borderless, unit of account, and payment infrastructure that is accessible and secure.

Reserve Rights Token

The Reserve Rights Token (RSR) holds two main functions within the ecosystem. Firstly, the RSR token is used by holders in governance, to vote in future proposals and updates to the protocol. Having a global community of token holders ensures that the Reserve Protocol remains a decentralized and self-sustainable platform.

Secondly, the Reserve Rights Token is used to maintain the price stability of the Reserve token (RSV). The Reserve token will begin with a target value of $1.00, but will eventually move from this price peg in the future.

The RSR token is what brings stability to the RSV token. The Reserve Protocol holds collateral tokens worth no less than 100% of the total value of all Reserve tokens. The portfolio that will collateralize the Reserve Protocol will begin with only a handful of assets, diversifying as the project matures to accommodate other tokenized asset classes.

If demand for Reserve was to go down, and the market price fell to below $1.00, arbitrageurs would be incentivized to buy Reserve and redeem it for $1.00 worth of collateral tokens from the Reserve smart contract. This would continue until the redemption price of $1.00 is achieved and there was no longer money to be made.

On the other hand, if demand for Reserve was to go up, arbitrageurs would be incentivized to buy up any newly minted tokens and sell them on the open market until the redemption price of $1.00 is achieved. Consequently, the Reserve Protocol has created innovative RSR tokenomics to combat this issue.

RSR Tokenomics

The Reserve token and Reserve Rights token together create a dual-token system that works to produce a censorship-resistant, decentralized stablecoin. This is achieved using innovative protocols to balance the price of the Reserve token at $1. Reserve Protocol inflates the Reserve Rights Token (RSR) and purchases digital assets in the Reserve Vault, to keep a constant Reserve token (RSV) price. We’ve explained this in more detail a bit further on.

Moralis Money

Stay ahead of the markets with real-time, on-chain data insights. Inform your trades with true market alpha!

At the time of writing, the Reserve Rights Token has a market cap of $360 million. Also, the RSR token has a capped supply of 100 billion tokens.

As many people are looking to learn a new skill or retrain in a new field, there has never been a better time to invest in yourself and your education. Blockchain is the most in-demand skill sector-wide and is already becoming one of the most exciting industries to work in.

If you have ideas for creating your own crypto project or token, Ivan on Tech Academy has a wide range of courses designed to fast-track your learning. Ivan on Tech Academy was created to help you achieve your goals and build new projects. Be sure to check out our Ethereum 101 and Javascript Programming courses if you want to become blockchain-certified in no-time!

Collateral Tokens

Collateral tokens are the third type of token within the Reserve Protocol ecosystem. The Reserve Protocol holds digital and tokenized assets as collateral for its Reserve tokens. At present, the portfolio of collateral tokens is a small but diverse collection. However, in the future, Reserve Protocol aims to hold tokenized assets such as property, commodities, or tokenized bonds.

Once upon a time, the value of the US dollar was pegged to gold, with a 100% backing. If you’re interested in reading about how in 1971 the US abandoned the gold standard and the Bretton Woods system, read our Bitcoin vs Stocks vs Gold article.

Bretton Woods

How Does Reserve Protocol Work?

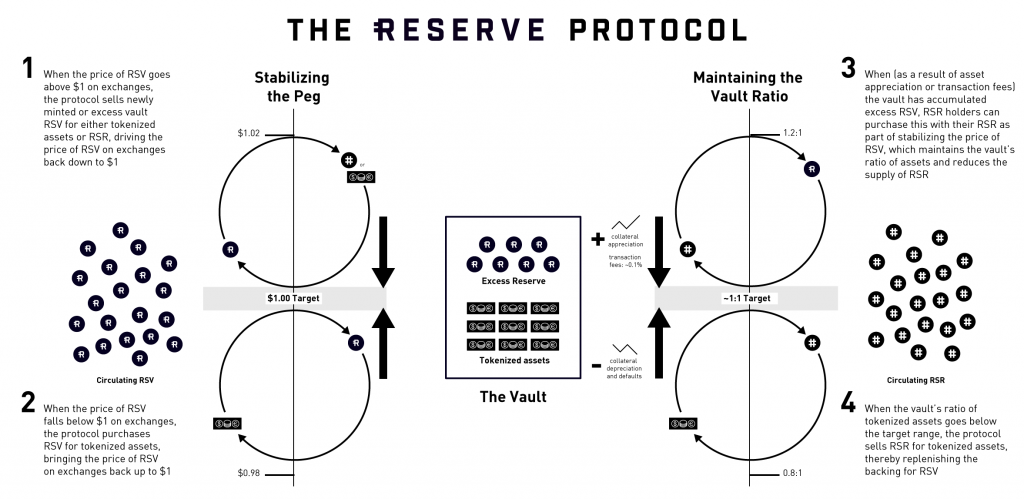

As previously mentioned, the dual-token system of the Reserve token (RSV) plus the Reserve Rights Token (RSR) work together to maintain a consistent RSV price. Below, we have explained in further detail exactly how this works. To maintain the balance of such an intricate protocol requires various aspects of the project to operate together harmoniously.

Reserve Vault - Stabilizing The Peg

The Reserve Vault can be thought of as the Reserve Protocol’s main processor “under the hood”. Specifically, the Reserve Vault stores assets, calculates, and triggers transactions. The vault holds Reserve Rights Tokens (RSR), Reserve tokens (RSV), plus tokenized assets as collateral. The Reserve Protocol is designed to keep the vault ratio of Reserve tokens and tokenized assets at 1:1.

If the price of RSV tokens goes above a dollar, the vault will sell newly minted RSV tokens into circulation. Alternatively, if there are any excess RSV tokens in the vault already, these will be sold first. RSV tokens are sold in exchange for either RSR tokens, or other tokenized assets. By increasing the supply of RSV tokens in circulation, this reduces the demand and therefore the price.

Conversely, sometimes the price of RSV is below $1 on exchanges. In this instance, the Reserve Protocol will purchase RSV tokens for tokenized assets within the vault. This increases the demand by reducing the supply, thus the RSV token price then returns to $1. The Reserve Protocol has designed the vault so that it can quickly calculate the amount of RSV tokens needed.

Reserve Vault - Vault Ratio

RSR tokenomics play an important part in recapitalizing the vault if the collateralized assets depreciate and lower the 1:1 ratio. If the ratio is 0.9:1 or below, the Reserve Protocol deploys the vault to sell RSR tokens for tokenized assets. As a result, these assets are then used as backing for the RSV token, maintaining a 100% collateralized Reserve token price.

Moreover, sometimes the value of the backing in the vault could increase to 1.3:1, for example. This may be due to transaction fees or asset appreciation. If this is the case, the excess RSV tokens can be purchased by RSR token holders. This helps to maintain the vault ratio of assets to collateral. This is also the case if the price of the RSV token needs stabilizing.

RSR tokenomics have a negative correlation with the Reserve token circulating supply. For example, as the number of RSV tokens in circulation increases, the number of RSR tokens decreases.

Reserve App

Currently, the Reserve download app is only available through Google Play in Venezuela, Argentina, and Columbia. In an AMA sessionpublished on Medium in November 2020, CEO Nevin Freeman stated: “I don’t know for sure, but I anticipate early next year we will decide to add iOS support”. Freeman also explained how the Reserve app operates using “independent payment processors”, which allow Reserve to operate in these countries.

From a user’s perspective, Reserve is an easy-to-use app that facilitates the buying, spending, and holding of US digital dollars and stablecoins. However, in the future, the Reserve app could grow to become an all-in-one financial application for automated payments on the blockchain.

Reserve Protocol & RSR Tokenomics Summary

Looking ahead, we can expect to see many new collateral types used within the Reserve Protocol smart contract. As DeFi continues to push the boundaries of tokenization into real estate, art, and commodities, we may soon see an array of asset classes used to back the Reserve Protocol and the Reserve token.

The Reserve Protocol is not re-inventing the wheel. However, the Reserve token achieves its stability in a refreshingly healthy way that is lacking in centralized stablecoins with dubious backing. Also, RSR tokenomics show that the project has a long-term goal structure in place and is future-oriented. This has drawn the attention of some esteemed investors and advisors, who are key to the success of the project. These include prominent Silicon Valley angel investors such as Paypal co-founder Peter Thiel, Coinbase Ventures, and YCombinator President Sam Altman, to name but a few.

Reserve began by serving businesses and individuals in Venezuela that are subject to high levels of inflation and restrictive capital measures. This has helped 400 stores and freelancers to retain their purchasing power and gain financial freedom by providing a stable digital currency. However, the RSR token is freely traded on popular crypto exchanges such as Binance. Furthermore, the RSV token brings a new dimension of stability to the world of decentralized finance and yield farming.

If you’d like to learn more about DeFi and yield farming, Ivan on Tech Academy is the perfect place to start your journey. Check out our DeFi 101 and DeFi 201 courses to get up-to-speed in the ever-evolving world of DeFi! Ivan on Tech Academy is the number one blockchain education suite available, with courses curated by our team of industry-leading experts that cover every area of the blockchain industry.